Are Prop Trading Firms Legit or Scams? A Trader’s Honest Take

In recent years, proprietary trading firms — or prop firms — have exploded in popularity. For traders, especially those without deep capital, these firms offer a way to trade big accounts without risking personal funds.

But with so many options out there — and some sketchy firms making big promises — the question on every trader’s mind is:

Are prop trading firms legit? Or are they just another trading scam in disguise?

In this blog post, we’ll answer that honestly, from a trader’s perspective. We’ll break down what legit prop firms look like, red flags to avoid, and how to tell the difference between a real opportunity and a money grab.

💼 What Is a Prop Trading Firm?

A proprietary trading firm provides traders with access to firm capital to trade the markets (often futures or forex). In return, the firm takes a share of your profits.

Unlike brokers or investment firms, you don’t need to bring your own money — you usually pay a small evaluation fee to prove your skills, and once you pass their rules, you get funded.

✅ Sounds like a win-win? It can be.

🚨 But it’s also where the line between legit and scammy can blur.

🎯 Legit vs. Scam: What’s the Difference?

Here’s a breakdown of the key differences between legit prop firms and the ones you should avoid:

| ✅ Legit Prop Firm | 🚨 Scammy or Questionable Firm |

| Offers real trading capital with a payout system | Only simulates funding, no real capital involved |

| Has a transparent evaluation process and clear rules | Vague rules, hidden clauses, or inconsistent enforcement |

| Pays out actual profits on time | Delays payouts, or finds reasons to deny them |

| Transparent support and trader community | No contact info, fake reviews, or spammy social proof |

| Offers real trading platforms (Rithmic, Tradovate, NinjaTrader, etc.) | Uses proprietary platforms that don’t connect to real markets |

| Doesn’t upsell constantly after failing challenges | Pushes resets and upgrades aggressively to milk fees |

💡 So… Are All Prop Firms Scams?

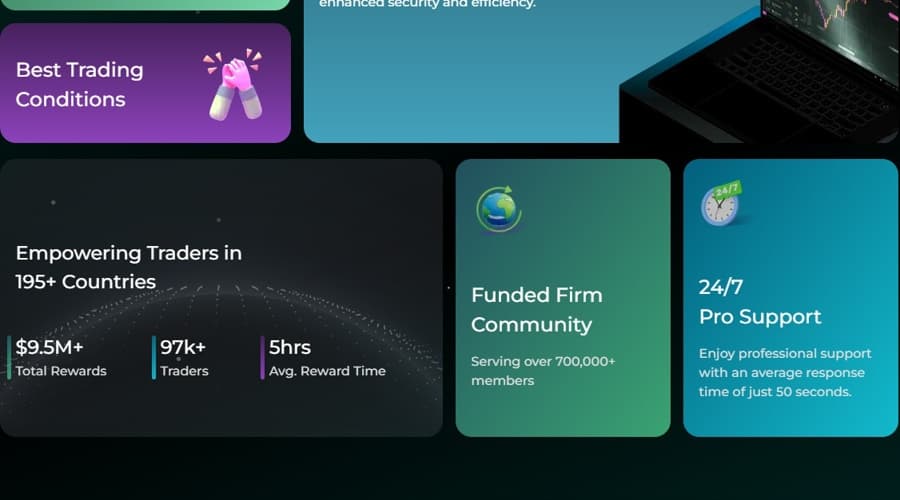

No. In fact, many prop firms are 100% legit and trader-focused — some even pay out millions monthly to funded traders.

But here’s the truth most won’t tell you:

⚠️ There are bad actors in the prop firm world. And they know how to appear legit.

Some firms are set up more like marketing machines than actual trading firms. Their goal isn’t to help you grow — it’s to keep you in an endless loop of evaluations, resets, and monthly subscriptions.

These aren’t exactly “scams” in the criminal sense, but they’re definitely predatory.

🔍 How to Spot a Legit Prop Firm: Trader Checklist

Use this checklist before signing up:

✅ 1. Do they offer real payouts?

- Look for proof of payouts to real traders — not just “testimonials” or Discord screenshots.

- Ask for payment timelines and methods.

✅ 2. Are their rules clear and achievable?

- Are profit targets and drawdowns realistic?

- Is the rulebook transparent?

✅ 3. Are they using respected platforms?

- Top firms use Rithmic, NinjaTrader, Tradovate, or MetaTrader.

- Be wary of firms using only in-house platforms with no external connectivity.

✅ 4. How do they treat failed traders?

- Do they offer feedback?

- Or do they push expensive resets and re-challenges without support?

✅ 5. What’s the community saying?

- Check Reddit, Trustpilot, YouTube reviews, and Discord groups.

- Watch out for fake reviews or over-the-top affiliate hype.

🧠 What’s the Business Model of Legit Prop Firms?

A legit prop firm makes money in two ways:

- Evaluation Fees: They charge traders a fee to take a challenge.

- Profit Splits: When you’re funded, they earn from your successful trades.

This model only works if the firm wants you to succeed — because your long-term success is how they profit most.

That’s why reputable firms invest in trader tools, host free webinars, and build education resources to help you win.

💰 Do Prop Firms Really Pay You?

Yes, if you follow the rules and reach the profit threshold, good prop firms pay out your share — often via bank transfer, PayPal, Deel, or even crypto.

Some popular prop firms offer:

- ✅ 80% to 90% profit splits

- ✅ First-payout bonuses

- ✅ Fast weekly or bi-weekly payouts

But always read the fine print. Some firms:

- Delay payments

- Require minimum profits

- Ban scalping or hold time rules that affect your strategy

🧨 Red Flags to Watch Out For

If you see any of these, run — not walk — away:

- ❌ No real trader proof or payout receipts

- ❌ Pushes “unlimited retries” but rarely funds traders

- ❌ Doesn’t clearly define drawdown or payout rules

- ❌ No mention of platform partnerships (Rithmic, etc.)

- ❌ Only appears on affiliate sites, nowhere else

- ❌ New firm with no transparency about owners/team

💬 Final Thoughts: Are Prop Firms Worth It?

Here’s the honest trader’s answer:

Prop firms are legit — if you choose the right one and know how to use it.

They’re not get-rich-quick schemes. They’re a chance to build your career, test your edge, and scale without risking your own capital.

But like any tool, you need to:

- Know what you’re getting into

- Read the rules

- Control your emotions

- Stay consistent

There are real opportunities out there. And there are also traps. Be smart. Ask questions. And when in doubt, ask other traders.

🔎 Where Can I Find Trusted Prop Firms?

That’s exactly what Prop Firm Store was built for. We test, review, and rate top prop firms — from big names to new challengers — and offer exclusive discounts to help traders get funded without the fluff.

✅ Compare firms side-by-side

✅ Get real user reviews

✅ Find transparent payout terms

✅ Save with discount codes

👉 [Browse the Best Prop Firms Now]

Lucid Trading

Lucid Trading